23+ Indiana Income Calculator

Web Calculate your Indiana state income tax with the following six steps. Refer to employee withholding certificates and current tax brackets to calculate federal income tax.

Pdf Epdf Pub Journal Of Cuneiform Studies Jcs Salar Faraji Academia Edu

Web The adjusted annual salary can be calculated as.

. Your household income location filing status and number of personal exemptions. Adjusted gross income Itemized deductions Exemptions State taxable income. Web This calculator provides an estimate of a potential members eligibility and how much the members monthly contribution would be.

Web Gross income minus deductions. Apart from the state and county tax the calculator computes federal tax social security tax. Web Heres how to calculate it.

The state income tax system in Indiana only has a single tax bracket. Its difficult to calculate net income without a SNAP calculator as there are additional deductions based on earned income and limits on amount of shelter-related deductions. Your average tax rate is 1198 and your marginal tax rate is.

Web This calculator estimates the average tax rate as the state income tax liability divided by the total gross income. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

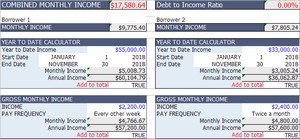

Web Monthly Income Calculator Get a quick picture of estimated monthly income. SNAP benefit amounts are based on a. 30 8 260 - 25 56400.

Indiana income tax calculator computes not only the Indiana state income tax but also the personal income tax payable to counties of Indiana. If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2000 and other dependents by 500. In State tax tax calculator.

Web For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Web Indiana Income Tax Calculator 2021 If you make 70000 a year living in the region of Indiana USA you will be taxed 10616. Web The Indiana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and Indiana State Income Tax Rates and Thresholds in 2023.

Extra income from outside of your job such as dividends or interest that usually dont have withholding taken out of them. How Income Taxes Are Calculated. Eligibility results and estimates of POWER account contributions from this calculator do not guarantee the amount of contribution or that an individual will be approved for HIP.

Gross income Retirement contributions Adjusted gross income. Looking for managed Payroll and benefits for your business. Calculate Federal Insurance Contribution Act FICA taxes using the latest rates for.

Calculated figures are for reference only. Determine your filing status. State taxable income State tax rate State tax liability.

All bi-weekly semi-monthly monthly and quarterly figures are derived from these annual calculations. Web Indiana Income Tax Calculator 2022. Web The state income tax rate in Indiana is over 3 while federal income tax rates range from 10 to 37 depending on your income.

Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. Taxable income 87050 Effective tax. Standard Income Calculator Base Pay Calculator USPS Employee Calculator Year To Date Income Hire Date Pay Period End Date Calculate Monthly Income.

At the bottom of the page are some of the expenses that can be deducted to calculate net income. Overview of Indiana Taxes Indiana has a flat tax rate meaning youre taxed at the same 323 rate regardless of your income level or filing status. This income tax calculator can help estimate your average income tax rate and your take home pay.

Web Estimate how much youll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a few steps with our tax calculator. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Web Our income tax calculator calculates your federal state and local taxes based on several key inputs.

How to calculate taxes taken out of a paycheck. Details of the personal income tax rates used in the 2023 Indiana State Calculator are published below the calculator. Get a free quote.

Web Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Some calculators may use taxable income when calculating the average tax rate. How many income tax brackets are there in Indiana.

Add up the total.

If You Make 130 000 Year In Nyc What Is Your Take Home Bi Weekly Payment Quora

Burnett Manor Apartments 315 East Stark St Rockville In Rentcafe

Paycheck Calculator Take Home Pay Calculator

Calculators For Home Buyers And Sellers In Pa

Indiana Salary Paycheck Calculator Gusto

Tax Partners The Trusted Partner For Tax Solutions In Canada And The United States

50 000 A Year Is How Much An Hour 2023 Guide Blue World Dreams

Cda Journal September 2022 Oral And Maxillofacial Radiology Diagnosis By California Dental Association Issuu

Indiana Salary Paycheck Calculator Gusto

Indiana Paycheck Calculator Smartasset

Penman S Art Journal Volume 23 Iampeth

35 Dollars An Hour Is How Much A Year Blue World Dreams

Household Income Varies By Region And Race

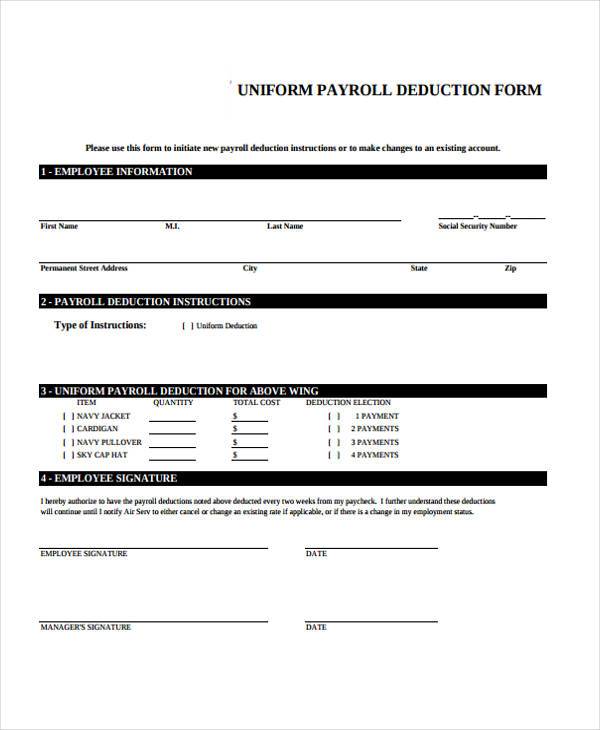

Free 34 Printable Payroll Forms In Pdf Excel Ms Word

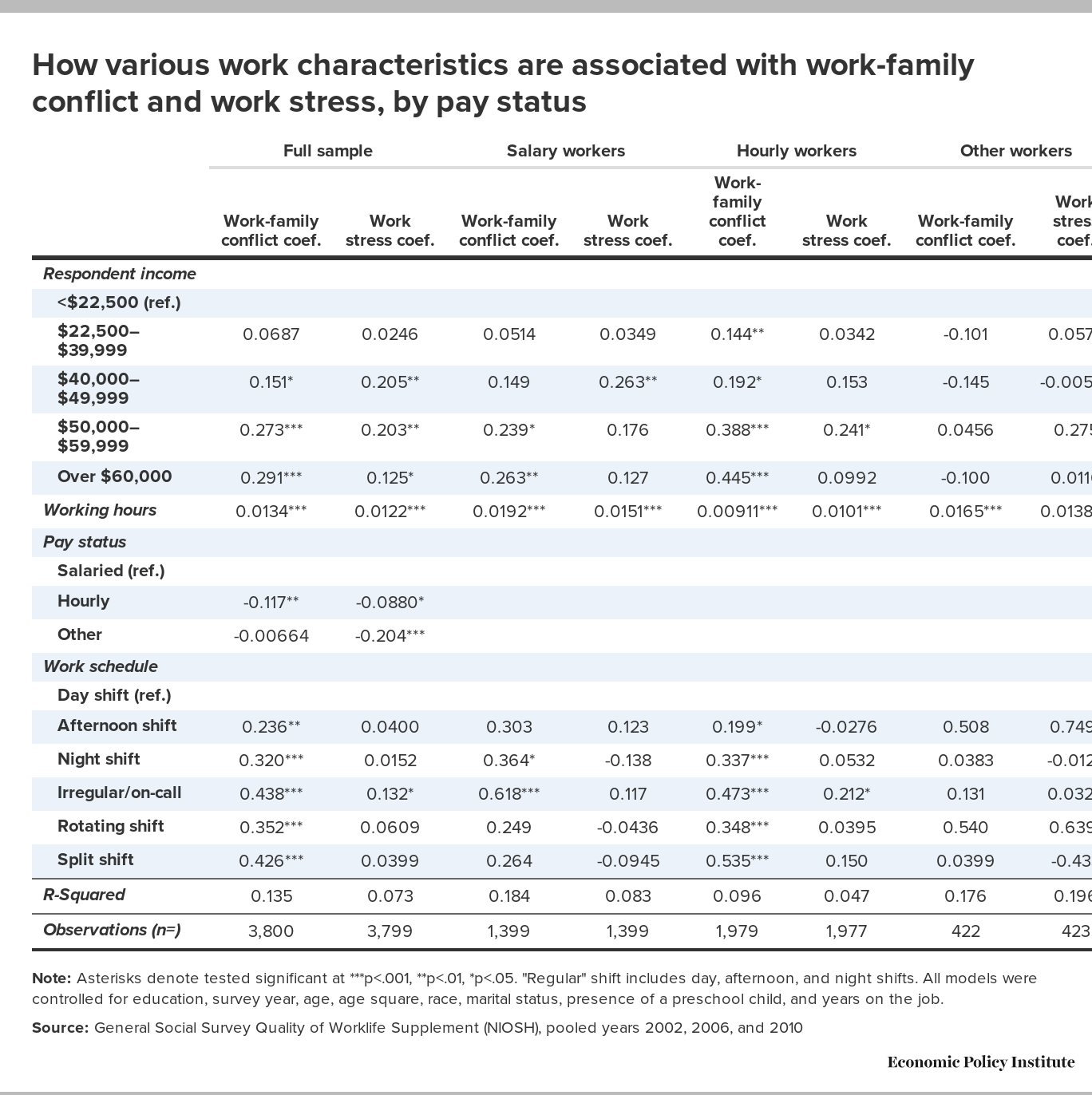

Irregular Work Scheduling And Its Consequences Economic Policy Institute

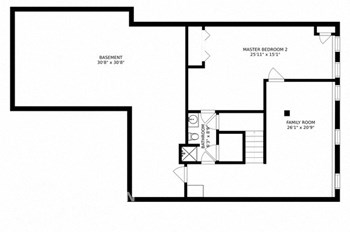

655 Gainesway Circle Road Valparaiso In 46385 Apartments 655 Gainesway Circle Road Valparaiso In Rentcafe

Paycheck Calculator Take Home Pay Calculator